Every employer shall for each year furnish to the Director General a return in the prescribed form Click here to read. EA Form and CP8D forms are available in both English and Malay versions but the Excel versions are only available in.

Striking Off A Company Under Section 549 A And 550 Of The Companies Act 2016

The Inland Revenue Board of Malaysia IRBM has announced that all employers which are companies including Labuan companies are mandatory to submit Return Form of an Employer Form E via e-Filing for the Year of Remuneration 2016 and onwards in accordance with subsection 83 1B of the Income Tax Act ITA 1967.

. 2016 E REMUNERATION FOR THE YEAR RETURN FORM OF EMPLOYER 1 Name of Employer as Registered Employers No. As a business in Malaysia youll want to avoid a fine of RM 200 RM 20000 andor a maximum of 6-month imprisonment term under the Income Tax Act Section 1201b. 8 with CCM or Others Date received 1 Date received 2.

Preferential Treatment Not Given Please state reasons Port of Discharge. Employers can start preparing for Form E now. We would like to hear about your experiences.

Setiap syarikat mesti mengemukakan Borang E menurut peruntukan seksyen 831 Akta Cukai Pendapatan 1967 Akta 53. We have located the specific links to these forms for easy download. 65392 employers were fined andor imprisoned for not submitting BorangForm E in the Year of Assessment 2014.

The deadline for submitting Form E is 31032022. Once that is done click on Download Form E sign and submit via E-Filing. A minimum fine of RM200 will be imposed by IRB for failure to prepare and submit the Form E to IRB as well as prepare and deliver Form EA to the employees.

2016 Bahasa Malaysia sahaja Malay Language Only Pautan Link. According to the law taxpayers must submit and commit. Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022.

Income Tax is a type of tax which government impose on income earned by personal or business such as monthly salary and business income. EA Form in Excel Download. Email confirmation from LHDN.

Basically its a form of declaration report to inform the IRB on the number of employees and the list of employees income details and must be submitted by 31st March of each calendar year. --Please Select-- Semua All Year. Form E to be indicated in Box 13.

--Please Select-- 2022 2021 2020 2019 2018 2017 2016 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 dan sebelum Semua All. This form ea must be prepared and provided to the employee for income tax purpose a b c e contributions paid by employee to approved. Means of transport and route as far as known 4.

81800 Ulu Tiram Johor Malaysia. Form E Borang E is a form required to be fill and submit to Inland Revenue Board of Malaysia IBRM by an employer. Our research team is conducting an online research interview 30mins to understand your thoughts and feelings during the pandemic.

Income Tax what is it. Download the latest Form E here. 6018-970 9800 607-859 0410 607-859 0410.

Starting from 2016 all Malaysian companies Sdn Bhd will need to declare a Form E to LHDN regardless there are employees or not. EA Form in PDF Download. As a token of appreciation you would receive a RM30.

2 3 Status of Employer 1 Government 2 Statutory 3 Private Sector 5 Income Tax No. In addition every employer shall for each calendar year prepare and render to his employee a statement of remuneration EA for private sector employees. Currently applies to exports of Indonesia Thailand Malaysia Vietnam the Philippines Singapore Brunei Cambodia Myanmar Laos and other countries and comply with the relevant provisions of the product as long as issued by the China - ASEAN free Trade Area of preferential.

2 E 3 Status of Employer 1 Government 2 Statutory 3 Private Sector Income Tax No. Double check all the E forms to ensure that everything is in place. Alternatively you can also view a short.

Employers may still submit Form E manually to IRB this year for Year of Assessment 2015 submission. Every company needs to submit Form E according to the Income Tax Act 1967 Akta 53. Form 4 02 OG Identification.

LHDN Malaysia announced the new Form E format for 2021 income tax declaration on 412022. Section 83 1A Income Tax Act 1967. According to the Inland Revenue Board of Malaysia an EA form is a Yearly Remuneration Statement that includes your salary for the past year.

Guide Sample of Completed Form. However employers are mandatory to furnish Form E online via E-filing effective Year of Assessment 2016 which is due for submission in Year 2017. Guide Sample of Completed Form.

EC for public sector employees. 2016 E REMUNERATION FOR THE YEAR RETURN FORM OF EMPLOYER 1 Name of Employer as Registered Employers No. MULAI TAHUN SARAAN 2016 FORM E - SUBMISSION ON AN ELECTRONIC MEDIUM OR BY WAY OF ELECTRONIC TRANSMISSION IS OBLIGATORY FOR EMPLOYERS WHICH ARE COMPANIES INCLUDING LABUAN COMPANIES WITH EFFECT.

Passport No7 Registration No. Please click on the above and maximise to view the guide ----. CP207 Remittance Slip for Form C.

This form ea must be prepared and provided to the employee for income tax purpose a b c e contributions paid by employee to approved. The main conditions for admission to the. The e-Filing system for.

2017 Form FOR THE YEAR REMUNERATION 1 Name of Employer as Registered E Employers No. Many of the Income Tax related forms are quite difficult to find. RETURN FORM OF EMPLOYER E 4 02 OG Identification.

For Official Use Departure date Preferential Treatment Given Vessels nameAircraft etc. Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from. Head over to Payroll Payroll Settings Form E.

Dont be part of this statistic for the new year. All companies Sdn Bhd must submit online for 2018 Form E and. 47 47A.

As an employer this will be your responsibility to ensure that the rest of your employees get their forms by the month of February every year. You have just read the article entitled Form E Malaysia 2018. Download Form - Employer Category.

8 with CCM or Others Date received 1 Date received 2. Have you had any badnegative experience where you felt you were treated differently during the COVID-19 pandemic. Click on Generate Form E for 2020.

Starting from 2016 onwards all. Employees details for any employees with annual gross remuneration of RM. Products consigned to Consignees name address FORM E country Issued in _____ Country See Overleaf Notes 3.

Immersive Career Mode Stars In New F1 2016 Trailer Multiplayer Championship Announced Supportive Thrill Circuit

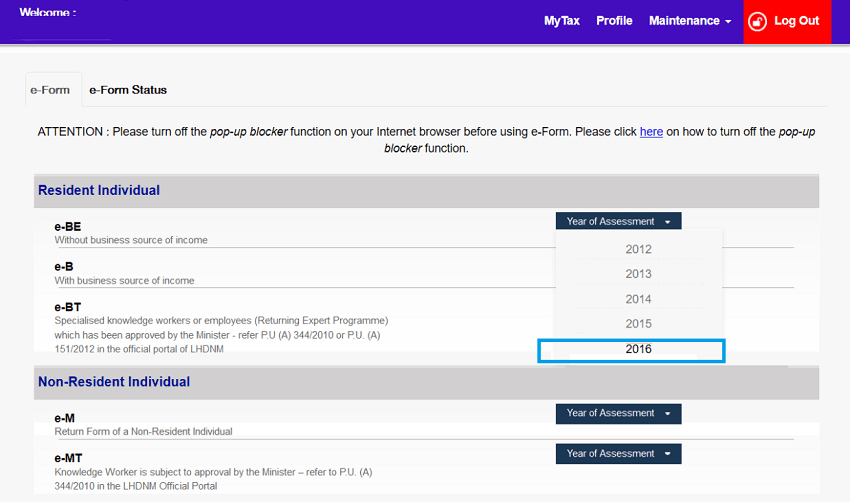

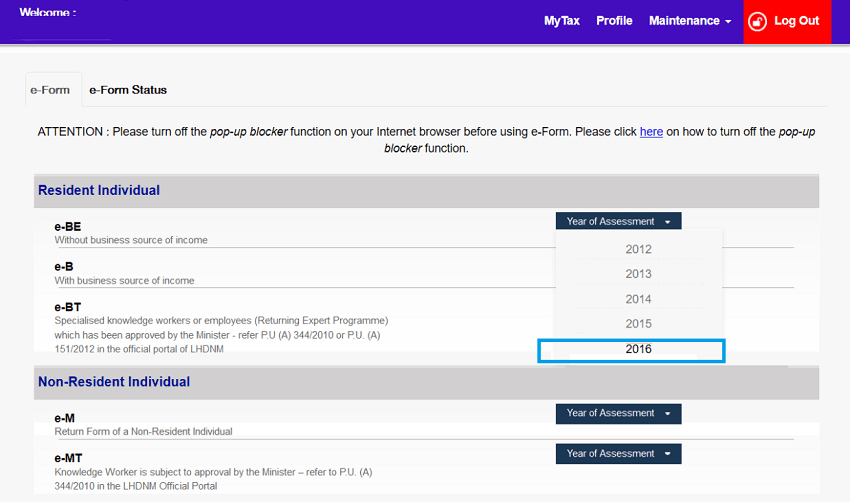

How To Step By Step Income Tax E Filing Guide Imoney

Evisa Malaysia And E Ntri Malaysia Apply Malaysia Visa How To Apply Visa Online Visa

How To Step By Step Income Tax E Filing Guide Imoney

How To Step By Step Income Tax E Filing Guide Imoney

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

How To Step By Step Income Tax E Filing Guide Imoney

7 Tips To File Malaysian Income Tax For Beginners

How To Step By Step Income Tax E Filing Guide Imoney

Ctos Lhdn E Filing Guide For Clueless Employees

How To Step By Step Income Tax E Filing Guide Imoney