Sales and Service Tax commonly known as SST is the new tax in Malaysia that was implemented on 1 September 2018. From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia.

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Service tax will only be applicable to life insurance policies where the policyholder is.

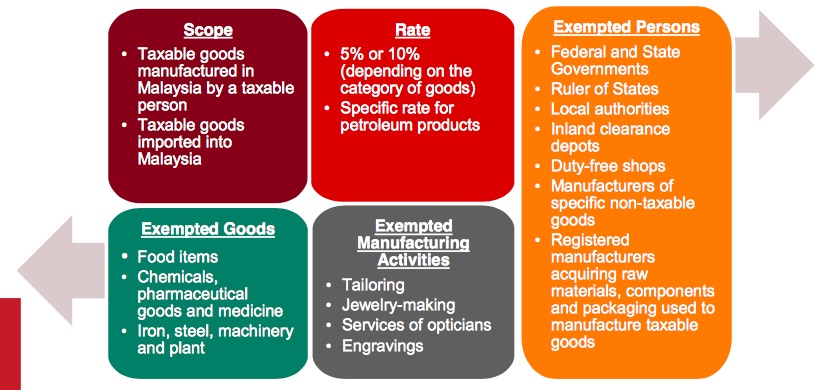

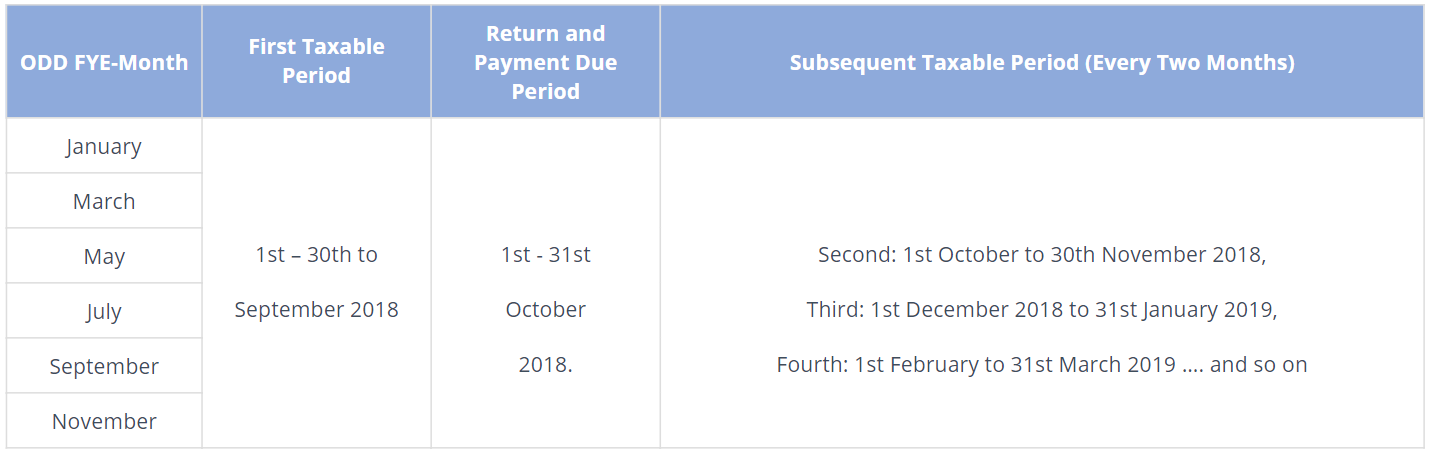

. Goods removed and invoice issued to the buyer on 28 August 2018. However the payment of the goods only made on 6. The Sales Tax is levied at the import or manufacturing levels and companies with a sales value of taxable goods exceeding RM500000 in a 12-month period are liable to be.

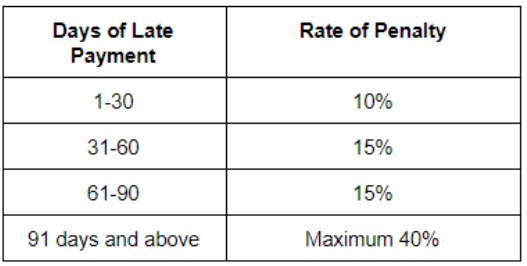

O SST Return has to be submitted regardless of whether. This sales and tax service is governed by the Royal Malaysian Customs Department. Such schemes under GST will not be applicable under SST.

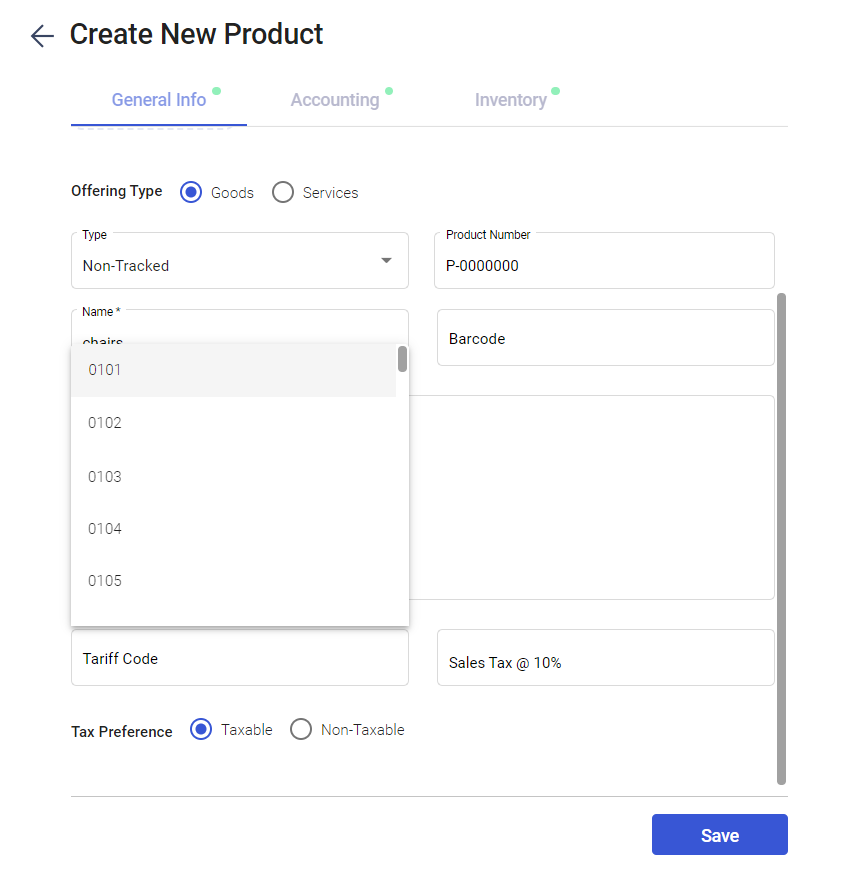

Sales Tax Determination Of Sale Value Of Taxable Goods Regulations 2018. Service tax is not. It stands for 10.

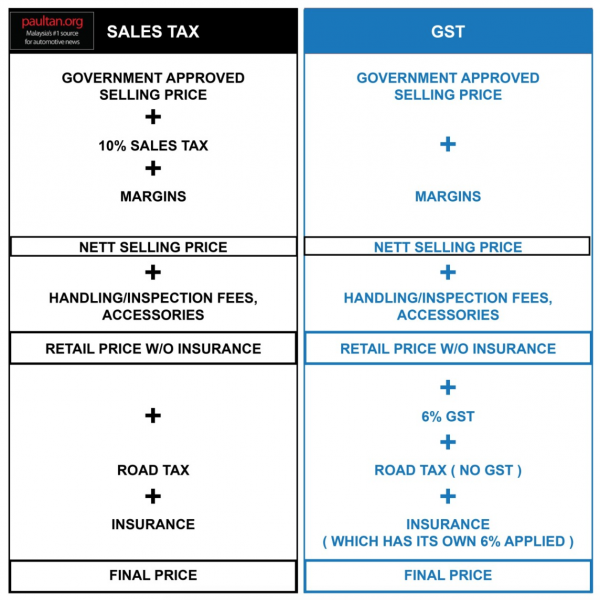

From 1 September 2018 the Sales and Services Tax SST will replace the Goods and Services Tax GST in Malaysia. Sst malaysia 2018 rate In general a services provider providing a taxable service under the Service Tax Act 2018 must register when the value of taxable services for a 12-month period exceeds a. Sales and Service Tax SST has replaced the Goods and Sales Tax GST on 1st September 2018 in Malaysia.

SST consist of 2 separate act. It replaced the Goods and Services Tax GST which was. Sales Tax Act and Service Tax.

VAT in Malaysia also known as Sales and Service Tax SST was implemented on September 1 2018 to replace the Goods and Services Tax GST Goods and Services Tax. Service Tax Regulations Service Tax Regulations 2018. Sales and service tax SST has been doing well in Malaysia before it was replaced a few years back.

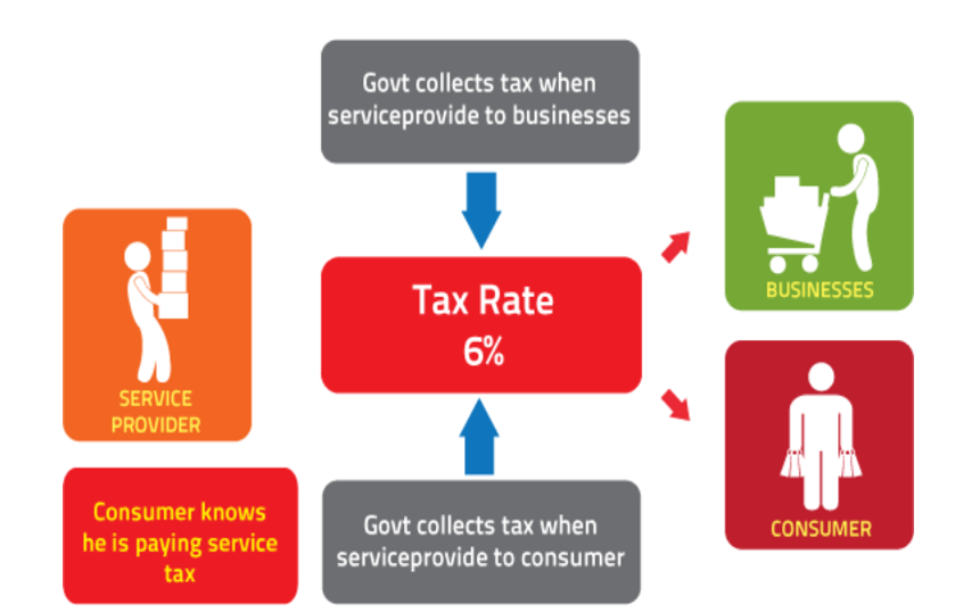

It was announced on September 1st 2018 that the Sales and Services Tax SST will be reinstated to replace the controversial Goods and Services Tax GST system GST. Malaysia reintroduced its sales and service tax SST indirect sales tax from. A 6 rate has been fixed for SST by the Ministry of Finance on 1st September 2018.

The rate could go up to 35 in the whole of 2019. Currently stands at 325. Here are the details on how the SST works - the.

With effect from 1 September 2018 the Sales and Service Tax SST will be implemented in Malaysia. GST has been set at zero from 1 June 2018 to be replaced by a Sales Tax on 1 September 2018.

Malaysia Proposed Sales And Service Tax Sst Implementation Framework Conventus Law

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst Vs Sst In Malaysia Mypf My

Sst Rate At 10 And 6 Synergy Tas

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Sales Tax And Service Tax 2018 Sage 300 Malaysia

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Calling All Senior Golfers Join In The Fun And Win Exciting Prizes Call Us Now For Bookings At 07 259 6152 3 Or Whatsapp Us At 0 Golf Resort Resort Golf

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

Malaysia Sst Sales And Service Tax A Complete Guide

Setup Tax Rates For Sst Sage 300 Malaysia

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Vs Sst A Snapshot At How We Are Going To Be Taxed